-

About us

- Know More

-

Products and Services

-

Products

Our History

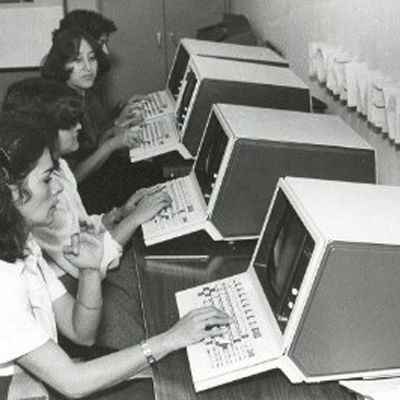

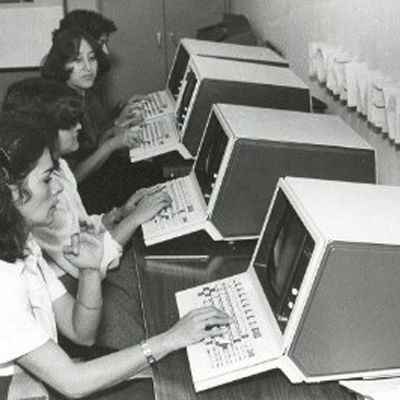

1978

S.D Indeval (Institución para el Depósito de Valores - S.D. Indeval, S.A de C.V) is legally constituted as a private for-profit entity. The Ministry of Finance and Public Credit grants Indeval the concession to operate as a Central Securities Depository.

1986

The Central Securities Depository is created.

1991

Transmission of SWIFT messages begins.

1993

Indeval joins ANNA (Association of National Numbering Agencies). With this, Indeval begins to provide the service of ISIN (International Security Identification Number) code assignment, based on the international standard ISO 6166. The ISIN code assigns the securities a unique identifier used in the Custody and Settlement of securities globally.

1995

Indeval strengthens its settlement model by incorporating the Delivery versus Payment (DVP) scheme.

1996

Indeval incorporates in its products the custody and settlement of government debt securities.

2000

The VALPRE system is released for Investment and Specialized Companies; with this, Indeval begins to provide the services of Securities Lending to the market.

2003

Indeval optimizes its algorithm with the incorporation of the Basel DvP 3 Settlement Model consisting of the settlement of net securities and cash at the end of the settlement cycle.

2004

Indeval strengthens its services by granting the Administration of Reports with the release of the System of Administration and Valuation of Collateralized Reports (SAVAR).

2007

Implementation of the Indeval Financial Protocol based on ISO 15022, improving the interoperability and execution of financial instructions.

2008

Release of the New Settlement System - Dali.

2010

Indeval obtains the 'Franz Edelman Award' for the Implementation of Operations Research in the Securities Settlement System

2013

Indeval incorporates the Indeval Financial Protocol in the International operation.

2015

Indeval begins with implementing the Principles Applicable to Financial Market Infrastructures (PFMI's), seeking to strengthen its risk management and adhere to global standards.

2018

SIC Project (International Trading System) - Consolidation of the Global Stock Market as an efficient platform to diversify international portfolios

2019

SWIFT Project -Indeval strengthens its customer and Global Custodian communication channels by implementing a global standard for financial transactions, reducing costs and risks inherent to Post-Trade activities.

2020

With the COVID-19 worldwide pandemic situation, Indeval triggers it's Business Continuity Plan. All services provided were successfull at all times with more than 90% of the personnel working from home.

2021

Taking a major step toward the electronification of the market, Indeval, in conjunction with the Bank of Mexico, implements Electronic Safekeeping as well as the “Requirements Guide” for connecting with participants

2022

As a key project, Indeval received approval from the Internal Revenue Service (IRS) to operate as a Qualified Intermediary (QI). This means that Indeval will have control over the tax withholding process for payments of securities listed on the SIC.

2023

Indeval joins SWIFT updates using dual ISO 15022 and 20022 messaging for receiving and sending information.v

2024

Kick Off “Post Trade Digital Evolution” project, which involves transforming the technological ecosystem of Indeval, Asigna, and CCV, as well as their operational processes. In May of this year, the settlement cycle was changed to T+1, migrating almost 60% of total issues.

2025

Promoting the operation of the SIC, Indeval announces an update to the fees charged for the transfer of securities. An important step toward reducing costs and facilitating access to the international market for investors of all sizes.

-

Products

S.D. Indeval,

Institución para el Depósito de Valores S.A. de C.V. © 2026

Paseo de la Reforma # 255, Piso 3, Colonia Cuauhtémoc, Delegación Cuauhtémoc, C.P. 06500, CDMX.Contact Us

Leave us your information and we will gladly assist you.

Enter your search term

Search