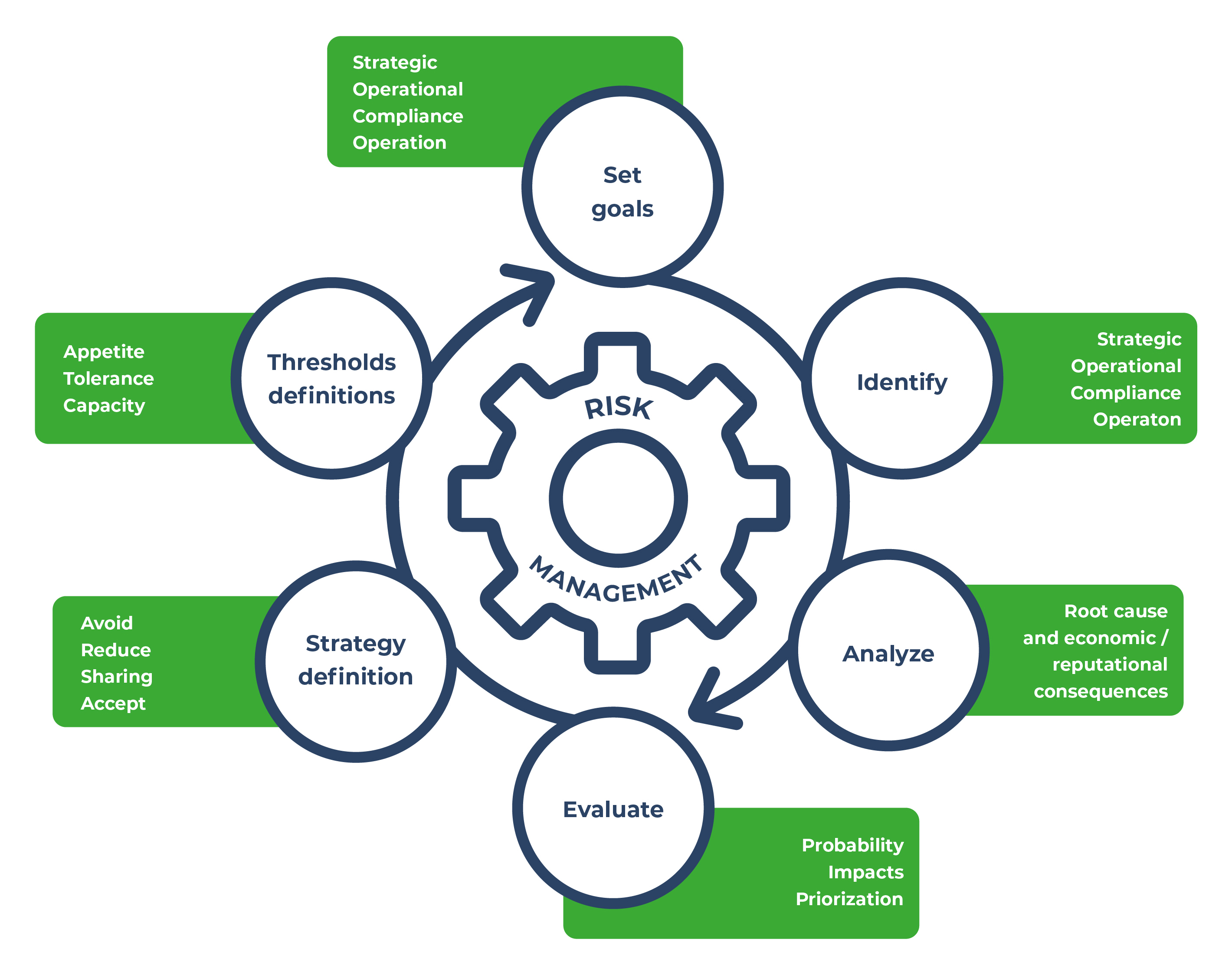

S.D. Indeval recognizes the importance of risk management in its processes and services. Therefore, through an Integral Risk Management Model following corporate governance and best practices, Indeval continuously monitors and follows up on its risks and controls.

Toca la imagen para ampliarla

Risk Management at Indeval, as part of Grupo BMV, considers in its Integral Risk Management Model, reference of international models such as COSO-II-ERM, COBIT 5 and best practices such as PFMIs (Principles Applicable to Financial Market Infrastructures). With this, it implements the guidelines, conceptual framework, techniques and tools, and manages strategically and in advance the possible adverse events that affect the fulfillment of the Group's objectives.

The Model's strategy is mainly based on the following stages:

- End-to-end process documentation

- Identification of risks and controls, including risks due to interdependencies.

- Analysis and Evaluation of Risk and Event Management Strategies

- Design and implementation of controls

- Controls monitoring and compliance

It also considers the following elements in risk management.

- Types of risks to be identified

- Techniques for risk identification

- Risk assessment

- Strategy (risk appetite, tolerance, and capacity).

- Internal control components

The Model's management is based on best practices and is carried out through the three lines of defense model. All the areas that makeup Indeval and BMV Group intervene to optimally mitigate risks, providing the market with greater security and operational stability.

The Risk Model is continuously managed by all levels and areas that make up S.D. Indeval, adopting and applying the guidelines established in Indeval's Risk Framework.The result of the management, known as the operational risk profile (event statistics, heat map, indicators, and action plans), is reported to Senior Management and the Board of Directors, which issue their feedback and action plans for critical events and risks. The rest of the events and risks are dealt with by the Directors and personnel of the first and second defense lines.

First line of defense: Business and Technology areas

Responsible for managing (identifying, mitigating, and reporting) risks identified by staff or external users.

Second line of defense: Internal Control, Operational Risk, Regulatory Compliance and Information Security.

Responsible for ensuring and supervising that the risk profile is aligned with the established policies and verifying that Indeval has an effective system of controls and oversight.

Third line of defense: Internal and External Auditing

Responsible for evaluating and making recommendations to improve internal controls, established rules and procedures.